Neom - Green hydrogen plant

The Hydrogen Mirage:

What It Really Means for UK Industry and Transport

Executive Summary

The world currently uses 100 million tonnes of hydrogen, and by 2050, demand for green hydrogen is expected to be around 500 million tonnes. However, green hydrogen infrastructure is expensive to build (£3 trillion just to meet the current hydrogen demand) and more costly to operate than electrical solutions.

Hydrogen is expected to focus on hard-to-electrify sectors, such as industrial feedstocks, including fertilisers and chemicals, as well as high-temperature heat for steel, cement, glass, and ceramics. Additionally, it may have applications in long-distance transport, shipping and aviation.

Blue hydrogen is likely to serve as a transitional solution, providing lower-carbon hydrogen at scale as renewable capacity expands and electrolysis costs decrease. It uses significantly less electricity, but like HVO (Hydrotreated Vegetable Oil), authenticity regarding carbon capture and methane leakage can be challenging.

To deliver the hydrogen for these sectors, the UK would need to produce around 3 to 4.5 million tonnes of green hydrogen per year by 2040. Generating this volume of hydrogen would require approximately 150 to 190 terawatt-hours of renewable electricity, equivalent to about 40% of the UK’s current annual power generation.

Green hydrogen is expensive, costing around £8 to £12 per kilogram, which is 3 to 4 times higher than grid electricity and 5 to 9 times higher than the cost of natural gas. Roughly, green hydrogen wastes 70% of its input energy before reaching the end user. The majority (+65%) of the current cost to produce green hydrogen is electricity, with more energy being consumed during the process than is left in the green hydrogen. This means additional investment is needed in renewable energy just to offset this energy loss.

Liquid hydrogen is also 18 times less dense than petrol, and at -253 °C, between 0.3% and 1% must be vented off to maintain its liquid form. This makes it difficult to transport and store, and mitigation techniques like converting hydrogen to Ammonia use more power (30%) and require additional, expensive infrastructure.

By contrast, renewable electricity and the electrification of road transport already offer immediate efficiency and cost benefits, often reducing both energy bills and emissions simultaneously, but need capital expenditure. Many businesses find that they have a strong commercial case for installing on-site solar, wind, or biogas systems, or securing off-site power purchase agreements and joining local microgrids that deliver cheaper and more stable electricity.

Hydrogen will play a vital role in achieving net zero, primarily as a targeted industrial solution, rather than a broad substitute for electricity.

Scale of Hydrogen Use and Possible Impact

Global hydrogen demand is approximately 100 million tonnes per year, primarily used for ammonia production and refining, and produced mainly from fossil fuels. Green hydrogen currently represents a tiny share of that total.

If hydrogen is used across hard-to-abate sectors, future demand could exceed 500 million tonnes per year by mid-century, which implies massive increases in renewable electricity capacity. Hence, focusing on hard-to-abate sectors for hydrogen is the logical priority.

In the UK, government policy anticipates up to 10 gigawatts of low-carbon hydrogen capacity by 2030, with a split between electrolytic and blue hydrogen (CCUS-enabled routes). The impact will be concentrated in industrial clusters and selected freight corridors, rather than nationwide coverage..

Need and Opportunity

Hydrogen’s value is most substantial where processes require high temperatures, where hydrogen is a feedstock, or where energy density is needed beyond the reach of current batteries. This includes glass and steel furnaces, fertilisers and chemicals, as well as long-range maritime and aviation applications.

The opportunity for UK businesses lies in integrating hydrogen where electrification is not viable, while continuing to prioritise direct electrification elsewhere.

Key Global and UK Projects

Internationally, the most significant single development is NEOM in Saudi Arabia (see video here), a multi-billion-dollar facility designed to produce approximately 600 tonnes per day and 0.24 million tonnes of hydrogen per year. This project involves installing a 1.6 GW wind farm, which is larger than the state of Washington, a 2.2 GW solar farm as large as the city of Manhattan, a 4 GW dedicated power grid, a 2.2 GW electrolysis plant, and 1.2 million tonnes of storage and port facilities. However, to fulfil current hydrogen requirements, 400 NEOM plants would be required at a total cost of £3 trillion; hence, the project illustrates the capital intensity of green hydrogen at scale relative to global demand.

In the UK, there are close to 200 active projects in the pipeline. Notable examples include HyNet North West, East Coast Hydrogen, Tees Green Hydrogen, the South Wales Industrial Cluster and the Cromarty Hydrogen Project.

The HyMarnham project in Newark, Nottinghamshire, has already started construction. The project is transforming the old High Marnham coal-fired power station into a clean energy hub by using hydrogen to decarbonise waste disposal operations.

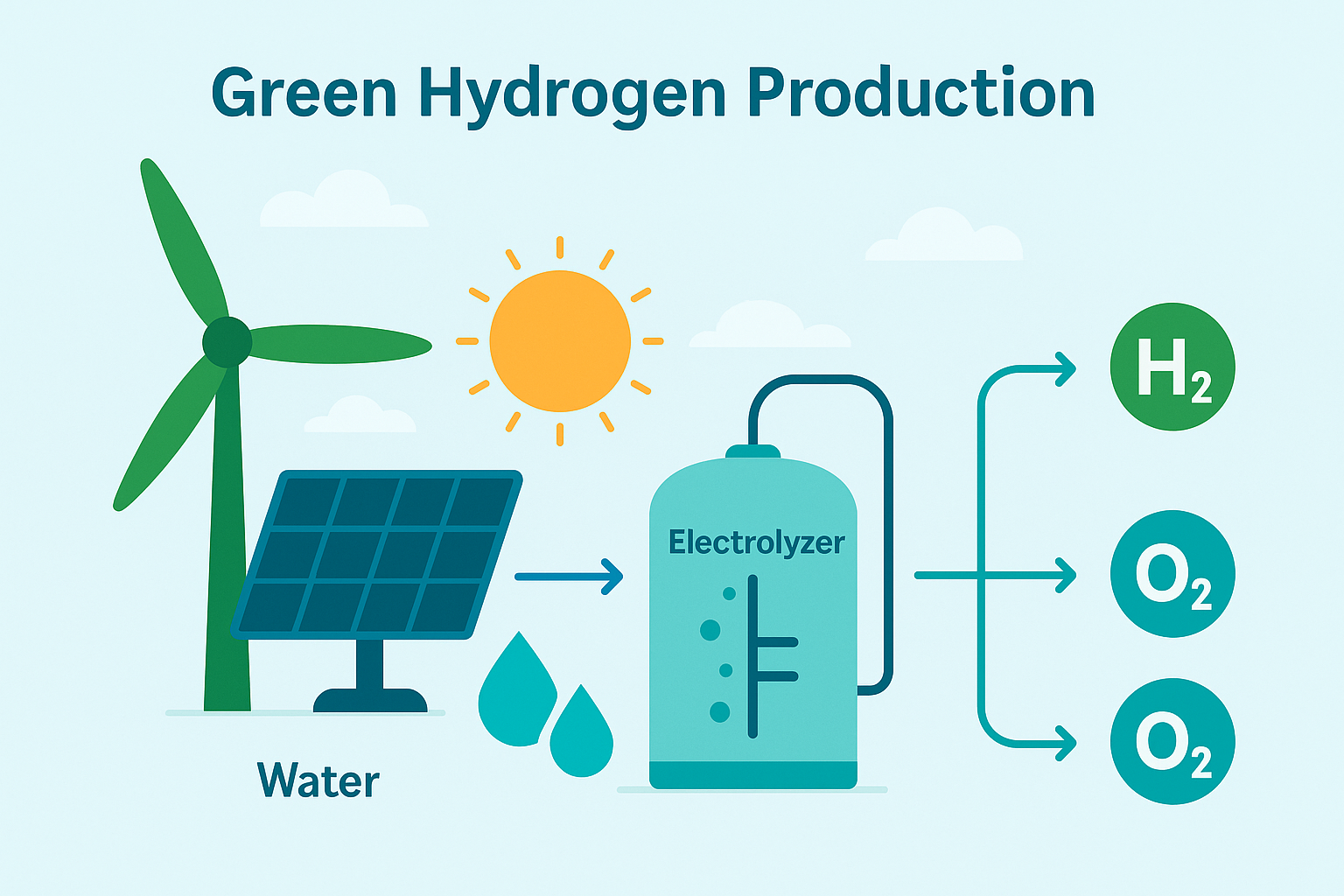

Cromarty Hydrogen Project in Northeast Scotland is another of the 10 projects. The project’s 3 5MW electrolysers – which use electricity to split water into hydrogen and oxygen – will power local industrial users, including distilleries.

Andrex and Kleenex producer Kimberly-Clark announces that it will be the first major consumer goods company in the UK to make a significant commitment to green hydrogen. Kimberly-Clark, together with energy partners HYRO, Carlton Power, and Schroders Greencoat, will invest a combined £125 million into HAR1 projects at two plants in Barrow-in-Furness, Cumbria and Northfleet, Kent.

Vertex Hydrogen is developing the UK’s first large-scale, low-carbon hydrogen production (blue hydrogen from methane with carbon capture, transitioning to green hydrogen) hub in the North West as part of the HyNet industrial cluster. The initial phase will generate around 1 GW of hydrogen capacity, enough to power a city the size of Liverpool, while capturing approximately 1.8 million tonnes of CO₂ each year. By 2030, Vertex expects to scale up to 4 GW, accounting for around 40% of the UK Government’s national hydrogen target. The company is investing about £1 billion to support the decarbonisation of key industries, helping manufacturers and logistics operators transition from fossil fuels to low-carbon energy

Government Hydrogen Allocation Rounds are advancing early commercialisation with the first wave of contracts awarded and a second wave shortlisted across glass, bricks, sustainable aviation fuels and waste-to-energy.

Key Barriers

Green and Blue Hydrogen Production

Blue hydrogen and green hydrogen share the same end product, pure hydrogen gas, but differ in their production methods and environmental impact.

Blue hydrogen is produced from natural gas through steam methane reforming or autothermal reforming, combined with carbon capture and storage, to reduce emissions. It can reduce lifecycle CO₂ emissions by 60% to 90% compared to grey hydrogen, depending on the amount of carbon captured and the extent of methane leakage during gas extraction and transportation.

In contrast, green hydrogen is produced through electrolysis, which splits water into hydrogen and oxygen using renewable electricity. It is virtually carbon-free when powered by wind or solar energy. Still, it is currently two to three times more expensive to produce than blue hydrogen due to high electricity costs and electrolyser investment.

Blue hydrogen is therefore likely to act as a transitional solution, providing lower-carbon hydrogen at scale while renewable capacity expands and electrolysis costs fall. Over time, as renewable energy becomes abundant and cheaper, green hydrogen is expected to replace blue hydrogen as the dominant long-term source for a net-zero economy. However, blue hydrogen’s lifecycle emissions are typically 15–25 kg CO₂e per kg H₂, compared with ~90 kg CO₂e/kg H₂ for grey hydrogen (unabated natural gas reforming), and <2 kg CO₂e/kg H₂ for green hydrogen from renewables.

Storage and Energy Density

Hydrogen’s energy per unit of mass is high, but per unit of volume it is extremely low. A 100 kg tank of liquid hydrogen requires approximately 1.4 cubic metres of space compared to 0.12 cubic metres for diesel. Hydrogen is over ten times less dense than diesel, and storing it as a gas requires pressures of up to 850 bar or temperatures as low as minus 253 degrees Celsius.

The Fuel Storage and Density Comparison shows why logistics, refuelling and bulk transport remain problematic. Approximately 18 hydrogen tube trailers are needed to move the same energy as a single petrol tanker. This makes hydrogen distribution costly and inefficient unless produced and consumed at the same site. Even when hydrogen is produced cleanly, moving thus remains a significant obstacle, especially over long distances and over extended time frames

NEOM – The world's largest Green Hydrogen Plant

The world’s largest project, NEOM, plans to manage this by converting it into ammonia, which is easier to ship. This is achieve by reacting the hydrogen with nitrogen (from air separation units) using a Haber Bosch reactor, which operates at 400–500 °C and 150–300 bar

The conversion equation is: N2+3H2→2NH3

The result: green ammonia produced entirely from renewable energy, without the use of fossil fuels. To ship liquid ammonia, it's necessary to store it in insulated, refrigerated tanks at −33 °C and near atmospheric pressure in specialised ammonia tankers, similar to LPG carriers.

At the destination, e.g., the UK, the ammonia is “cracked” back into hydrogen and nitrogen using the chemical reverse of the Haber–Bosch process: 2NH3→N2+3H. This is carried out at a higher temperature (600–900 °C) over a nickel-based or ruthenium catalyst, producing a gas mixture of hydrogen and nitrogen. The hydrogen is then separated and purified using membranes or pressure swing adsorption (PSA), ready for use in fuel cells, power generation, or industrial processes.

The positive aspect of this process is that it reduces transit losses as a function of hydrogen density and temperature. However, the downside is that turning hydrogen into ammonia and then back again at the destination consumes up to 30% of the original energy and requires expensive infrastructure (hydro crackers).

A large-scale green cracker can cost hundreds of millions of pounds, making it viable only for industrial users such as shipping, fertiliser, or steel production, not for widespread vehicle refuelling. Ideally, you avoid this process by making green hydrogen near the point of use.

The Costs Associated with Hydrogen

Capital Costs

Achieving UK net zero primarily through direct electrification (renewables, grid reinforcement, EVs, and heat pumps) is projected to cost around £400 to £500 billion by 2050. This equates to a capital intensity of roughly £1,000 to £1,200 per delivered kW of clean electricity across the economy.

Building a parallel green hydrogen system to deliver similar usable energy would require an additional £600 to £800 billion in new infrastructure investment. Combined, the total system capital intensity for green hydrogen exceeds £3,000 per kW of usable energy, compared to about £1,100 per kW for direct electrification.

Key Reasons for increased costs are

Electrolyser capacity alone would require about £40–£50 billion to reach 10 GW by 2030, scaling to £200 to £250 billion by 2050

Renewable generation dedicated to hydrogen production would add approximately £200 to £250 billion, given the energy losses (and additional capacity required).

Hydrogen storage, pipelines, and compression systems are expected to add £150 to £200 billion, based on National Grid’s Future Energy Scenarios.

End-use conversion equipment — including hydrogen-ready boilers, turbines, and fuel cells would cost another £100 to £150 billion, assuming partial uptake

The Hydrogen Multiplier

The hydrogen multiplier is the ratio of the cost of electricity (£/MWh) to the cost of green hydrogen (£/MWh) after accounting for all conversion and handling losses.

It includes:

Renewable Electricity Unit Price - including grid costs

Electrolyser efficiency losses: Only around 60–70% of electrical energy becomes usable hydrogen energy.

Capital costs: The cost of electrolysers, compressors, storage tanks, and associated financing.

Operations and maintenance: Stack replacements, deionised water supply, and ongoing maintenance.

Storage, transport, and distribution: Compressing, cooling, or liquefying hydrogen adds further cost.

Taxes, tariffs, and grid charges: Green hydrogen still incurs system costs even when renewable power is used.

Most global hydrogen plans assume that green hydrogen (made from renewable electricity) will one day cost around £1 per kg. Today, it is around £10 to £12 per kg.

So, if we examine how the £11/kg cost is currently made up, that’s a good place to start.

So, if we want to consider what the hydrogen cost per MWh is in 2040,

What should we assume are reasonable cost reductions based on logical assumptions over the next 15 years?

Based on the evidence, the following assumptions seem reasonable yet appropriately aggressive.

A low commercial electricity cost from £100MWh of £60/MWh (. The cost of the cheapest wind and solar solutions. Note the current consumer price cap is £263/MWh.

A reduction in capex costs from £1000/kW to £500 kW as more providers enter the market and installation becomes more standardised

A reduction in the cost of capital (WACC) from 8% to 4% through growing confidence in the commerciality of hydrogen and the onboarding of sovereign-grade funders.

This would create a hydrogen fuelled electricity cost of £201/MWh with a multiplier of 3.35 times the price of the electricity input

To make a better comparison with direct electrification, we need to convert hydrogen £/kg into £/MWh

The lower heating value (LHV) of hydrogen = 33.33 kWh/kg therefore 1 MWh = 1,000 kWh

Thus - 1 kg H₂=0.0333 MWh, 1 MWh H₂=30.0 kg H₂, So to convert £/kg → £/MWh, multiply by 30.

UK Government Funding

Project Costs associated with hydrogen trials are 75% funded by the government

As hydrogen is so expensive, the UK’s first wave of green hydrogen trials is being underwritten by the government, with its contribution ranging between 70% and 80% of the total project costs. This is a combination of both capital grants and revenue support. The primary support mechanism, the Hydrogen Production Business Model (HPBM), guarantees producers a fixed “strike price” for hydrogen, typically around £8 to £12 per kilogram, even though current market demand would only sustain prices of £2 to £3 per kilogram. This means the state is covering most of the price gap, making production commercially viable. In parallel, the Net Zero Hydrogen Fund (NZHF) provides up to £240 million in capital grants, typically covering 20% to 30% of plant construction costs for early-stage projects. Taken together, these incentives mean that the UK government is paying roughly three-quarters of the full cost of producing and distributing early green hydrogen in 2025. This level of intervention aims to de-risk first-mover projects, attract private investment, and develop shared infrastructure in industrial clusters, such as HyNet Northwest and Teesside. It is expected that subsidy levels will decrease to around 30-40% of costs by 2030, as technology advances and renewable electricity prices decline. It is essential to appreciate that participants are more likely to have a favourable view because they are involved, and they are receiving hydrogen for £2 to £3 per kilogram.

Impact on Manufacturing and Industrial Heat

Hydrogen has genuine potential in industrial heat and manufacturing, particularly in processes that require very high temperatures (above 400°C) — where electricity or heat pumps aren’t yet viable. These include:

Steelmaking (replacing coal in blast furnaces with hydrogen-based direct reduction)

Cement kilns (replacing fossil fuels in clinker production)

Glass and ceramics (requiring flame temperatures above 1,000°C)

Refining, chemicals, and fertilisers (as both a heat source and feedstock)

How It Works

Combustion for Heat - Hydrogen can be burned directly in modified industrial burners or kilns, producing flame temperatures above 2,000°C and emitting only water vapour (H₂O).

However, because hydrogen flames burn hotter and faster, existing equipment must be retrofitted with hydrogen-compatible burners and control systems.

Mixing hydrogen with natural gas (e.g. 20–30%) can be a transitional step in existing systems.

Feedstock Replacement - In ammonia, methanol, and refining, hydrogen is already widely used, but it’s mostly “grey hydrogen,” made from natural gas. Replacing this with green hydrogen (produced by electrolysis powered by renewables) eliminates significant CO₂ emissions from industrial chemistry.

For example, producing 1 tonne of ammonia emits about 2 tonnes of CO₂ today; green hydrogen can reduce that to near-zero.

Reduction Agent in Steelmaking - In direct reduced iron (DRI) processes, hydrogen can replace coke as the reducing agent to remove oxygen from iron ore (Fe₂O₃ + 3H₂ → 2Fe + 3H₂O).

The result, “green steel”, is already being piloted by HYBRIT (Sweden) and H2 Green Steel.

Each tonne of conventional steel emits roughly 1.8 tonnes of CO₂; hydrogen-based processes could eliminate nearly all of that

Across six key industrial sectors: steel, fertiliser, cement, animal feed, ceramics, and glass, the UK currently produces around 42 million tonnes of CO₂e each year, representing roughly 8% of total national emissions.

Transitioning these sectors to green hydrogen could theoretically reduce CO₂e emissions by up to 34 million tonnes, or approximately 80% of their combined footprint, at a total additional annual cost of around £11 billion. This equates to an average abatement cost of about £323 per tonne of CO₂ avoided, placing hydrogen-based decarbonisation among the more expensive industrial mitigation pathways. While hydrogen has the potential to eliminate nearly all fossil fuel emissions in steel and fertiliser, its impact in cement, ceramics, and glass is limited by process-related CO₂ that would still require carbon capture or material innovation. Overall, hydrogen represents a crucial but costly lever in the UK’s net-zero strategy, capable of cutting around 8% of national emissions. However, it does so at a significantly higher cost per tonne than renewables, electrification, or efficiency measures.

Hydrogen will play a crucial role in decarbonising the UK’s hardest-to-abate sectors, including steel, fertilisers, cement, glass, ceramics, and animal feed; however, the most significant opportunities lie in how companies prepare now. The transition will favour those who lower their energy exposure, build flexibility into their systems, and align with regional hydrogen and renewable energy ecosystems.

Hydrogen Transition Pathways: What Businesses Should Focus On

Steel

Hydrogen-based steelmaking is advancing quickly, but costs remain high. Most producers will source hydrogen from shared industrial hubs or third-party suppliers; however, electricity will still be critical for electric arc furnaces and their supporting systems. Companies can improve cost control by securing low-cost renewable electricity through off-site power purchase agreements (PPAs) or, where practical, limited on-site generation for auxiliary loads such as compressors and treatment systems. Participation in industrial clusters will help stabilise hydrogen pricing and provide access to shared storage and carbon capture networks. Expanding electric arc furnace (EAF) capacity using scrap feedstock remains the most immediate and commercially viable step toward lower emissions.

Fertilisers

Future fertiliser production will rely on green hydrogen or ammonia supplied from dedicated producers. However, electricity demand will still rise for compression, separation, and potentially carbon capture systems. Companies should focus on PPAs with renewable developers to secure predictable electricity costs and assess opportunities for co-located renewable supply where land or infrastructure allows. Integration within hydrogen or chemical clusters can reduce costs and ensure reliable access to feedstock while creating synergies with nearby farms and hydrogen users in early low-carbon supply chains.

Cement

Cement producers will primarily purchase hydrogen as a fuel to replace fossil gas and coal in kilns. Electricity will remain essential for grinding, processing, and any carbon capture systems used to treat process emissions. Firms should explore long-term renewable electricity contracts and microgrid participation to stabilise operational costs. Fuel-flexible kiln designs that can switch between hydrogen, biomass, or waste-derived fuels will help manage energy price volatility, while collaboration on alternative binders and CO₂ utilisation offers additional value opportunities.

Glass

Hydrogen will increasingly power high-temperature furnaces, but significant electrical demand will remain for melting, shaping, and recycling operations. Businesses should evaluate hybrid furnaces that can utilise hydrogen in conjunction with electric heating, and secure renewable electricity contracts to support their loads. Industrial clusters can offer shared hydrogen pipelines and waste heat recovery systems. Expanding glass cullet recycling and collaborating on early offtake contracts will strengthen cost resilience as the hydrogen market develops.

Ceramics

The ceramics industry can gain an early advantage by retrofitting kilns for hybrid hydrogen-electric use and recovering waste heat to improve energy efficiency. Partnering with technology developers and renewable energy providers on on-site solar or small wind generation can further control costs. Pilot projects testing hydrogen blends in controlled environments will provide valuable insight before scaling up production.

Animal Feed

Hydrogen use in animal feed manufacturing will be limited but can support high-heat drying and upstream fertiliser decarbonisation. Electricity will remain the dominant energy source for milling and processing. Businesses can reduce long-term costs by improving energy efficiency, electrifying dryers, and sourcing renewable electricity through PPAs or participation in local microgrids. Collaboration with low-carbon fertiliser suppliers and agricultural logistics partners will amplify the overall emission benefit across the value chain.

Impact on Transport and Logistics

For UK road fleets, battery-electric options now lead on total cost of ownership for most routes. Hydrogen is often said to be more credible in specific use cases such as long-haul corridors, high daily utilisation and where payload-time trade-offs justify higher fuel costs. However, there is over 60TWh and £8bn of electrical savings associated with moving to eHGVs. Additionally, eHGVs are rapidly evolving and becoming more energy-efficient, with more efficient fuel cells and longer-range batteries. Plus, the availability of rapid and megawatt charging is improving daily.

A hydrogen fuel cell turns hydrogen gas (H₂) into electricity, heat, and water without combustion. Inside each cell, hydrogen enters the anode, where a platinum catalyst splits it into protons and electrons. The electrons flow through an external circuit to power an electric motor. At the same time, protons pass through a proton exchange membrane (PEM), a wafer-thin polymer film such as Nafion, to the cathode. There, they combine with oxygen (O₂) from the air to form water vapour (H₂O), the only emission. Hundreds of these cells are stacked to create enough voltage to drive the vehicle, with a small battery acting as a buffer for acceleration and regenerative braking.

Hydrogen is stored in the vehicle as a compressed gas at up to 700 bar (10,000 psi) in carbon-fibre composite tanks. These are highly engineered, multi-layered vessels tested to withstand over twice their working pressure, crash impacts, and even direct fire exposure. If damaged, tanks are designed to vent hydrogen safely upward, and in real-world use, there have been no recorded tank ruptures in commercial fuel-cell vehicles. In short, the system is robust and well-regulated but remains costly and complex.

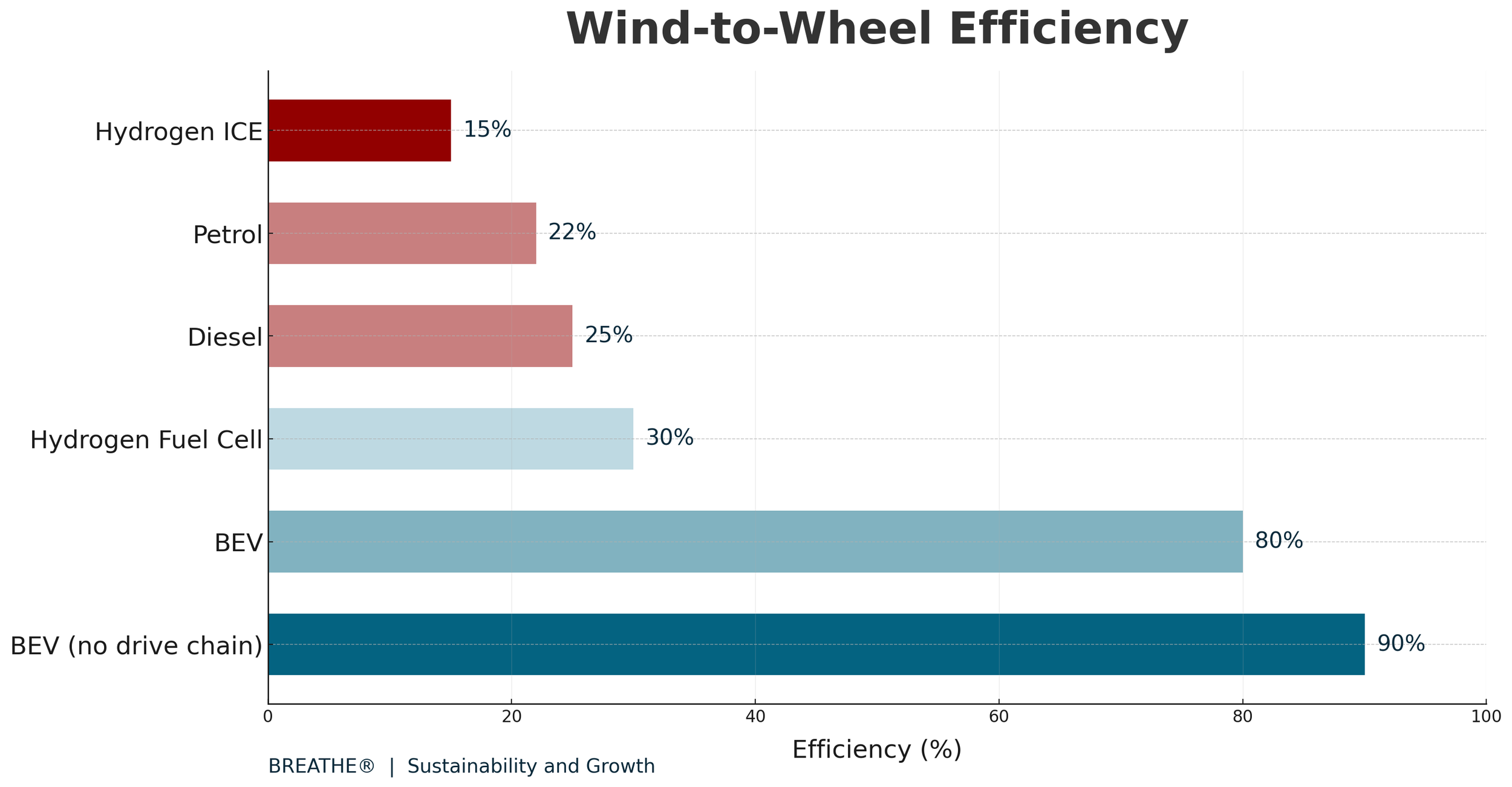

While the concept is elegant, the energy pathway is highly inefficient. From renewable electricity to hydrogen production, compression, transport, and conversion back to electricity, around 70% of the original energy is lost. The result is a “wind-to-wheel” efficiency of roughly 30% for fuel-cell vehicles. In comparison, battery-electric vehicles (BEVs) convert 80 to 90% of their input energy into motion. Hydrogen internal combustion engines (ICEs) are even worse, achieving only approximately 15% efficiency, which is lower than that of diesel or petrol. They also produce NOx emissions, undermining their environmental case.

Because of these losses, along with the costs of expensive materials, new refuelling infrastructure, and limited energy efficiency, hydrogen is unlikely to become a mainstream road-transport fuel. Its real value lies in hard-to-electrify sectors like shipping, aviation, steel, and fertilisers, where batteries can’t yet compete on energy density or process compatibility. However, the government wants to test hydrogen deployment (for due diligence reasons), which is challenging because the current UK hydrogen refuelling infrastructure is limited / non-existent compared to electric charging. Therefore, they are acting on this through a few well-funded projects, such as ZENFreight and HyHAUL, operating in concentrated, defined hubs.

Conclusion

Hydrogen has real potential, but it is not a single solution for decarbonisation. It should be viewed as one tool among many that will help specific industries achieve deep carbon reductions. For most UK businesses, renewables and electrification provide faster, cheaper, and more reliable returns. Installing on-site solar, wind, or biogas generation, connecting to microgrids, and electrifying vehicle fleets can reduce costs immediately and continue to deliver savings over time.

By comparison, hydrogen currently increases both energy use and cost. Producing and transporting it requires large amounts of renewable power, meaning it is unlikely to deliver cost reductions in the near or medium term. Its most significant value lies in applications that cannot be electrified, such as steelmaking, fertiliser production, cement, glass, ceramics, and other high-temperature industrial processes. Serving these sectors alone will still require around three to four and a half million tonnes of green hydrogen each year and approximately 150 to 190 terawatt-hours of renewable electricity, equivalent to roughly 40% of the UK’s current power generation.

Progress in hydrogen production will depend on the availability of affordable renewable energy, shared industrial infrastructure, and collaboration within industrial clusters. For most businesses, the most effective strategy is to begin with electrification and efficiency, invest in renewable self-generation, and explore hydrogen adoption only where it adds genuine value or where alternatives are technically limited.

The UK’s transition will be driven by flexibility and innovation, rather than relying on a single technology. The businesses that act early to reduce energy costs, produce clean power, and adopt the right mix of technologies will lead the way in demonstrating that sustainability and growth can coexist and progress together.

BREATHE® — Sustainability and Growth

Helping UK industry and logistics leaders plan smarter, evidence-based energy transitions.

Dated 24th October 2025

Author David Gardner