The Business Economics

for Green Energy

Executive Summary

UK businesses face some of the highest and most volatile energy costs in the developed world. Domestic oil and gas production is in structural decline, leaving the UK exposed to global commodity markets. At the same time, the UK has world-class renewable resources, including offshore wind, onshore wind, and solar, that are consistently cheaper than imported gas and can reset the foundations of competitiveness.

By 2025, gas-fired electricity is expected to cost around £174/MWh delivered, rising to £240/MWh by 2040. In contrast, offshore wind, onshore wind, and utility-scale solar are holding steady at £90 to £100/MWh. In comparison, commercial rooftop solar is already available at £95 to £140/MWh and onsite wind at £40 to £80/MWh, both with scope to fall further. By the 2030s, all fossil fuels will be at least twice as expensive as renewables. On the demand side, EVs are on average 30 to 40% cheaper to run per mile than petrol or diesel, and heat pumps are forecast to undercut gas boilers by the mid-2030s.

The direct opportunity for business is transformative:

Commercial rooftops: Covering 40% of the UK’s 2.5 billion m² of commercial roof space could deliver around 190 TWh of clean electricity annually, equal to two-thirds of current UK electricity demand. At current business power prices, this equates to £45 to £50 billion in annual savings, with a simple payback of under five years.

Fleet electrification: Switching company cars, vans, HGVs, buses, and coaches from petrol and diesel (around 285 TWh of fuel energy today) to EVs would cut demand to about 81 TWh of electricity, a 72% energy reduction. System-level fuel and maintenance savings could reach £25 to £30 billion per year, with workplace charging further enhanced by on-site renewables.

On-site wind: Between 3,000 and 7,000 large commercial and industrial sites could host a modern 1.5 to 2 MW turbine, generating 15 to 35 TWh of clean electricity annually, equal to 5 to 12% of current UK demand. With streamlined planning and grid access, this potential could rise to 45 to 60 TWh, providing up to 20% of UK electricity demand. At a levelised cost of £40 to £80/MWh, on-site wind is significantly cheaper than grid electricity and could cut collective business energy costs by £2 to £4 billion annually.

This transition is not only an environmental imperative but also an economic necessity. The US, China and India have grown faster in part because cheap domestic energy underpins competitiveness, while higher electricity costs in the UK and EU have constrained productivity. By anchoring energy costs with renewables, UK businesses can free capital for investment, stabilise margins, and re-energise GDP growth.

For UK businesses, the path is clear. Early adoption of rooftop solar, on-site wind, electrified fleets, and low-carbon heating is no longer just about net zero. It is a decisive strategy to lower costs, build resilience against volatile fossil markets, and secure long-term global competitiveness.

Background

To restore the UK's competitiveness and growth, green energy is a critical part.

Taken together, these charts show how the UK’s high and volatile energy costs have suppressed incomes, slowed productivity, and limited GDP growth compared to global peers. Restoring competitiveness requires cutting energy costs, and the clear pathway is through renewables, which are already cheaper than fossil fuels and offer long-term price stability.

Cumulative Real GDP Growth

The UK and EU have struggled with slower GDP growth since the financial crisis, while the US has pulled ahead and China and India surged ahead. Access to cheaper energy has been one factor enabling faster expansion elsewhere. High UK energy costs have contributed to weaker economic momentum and resilience

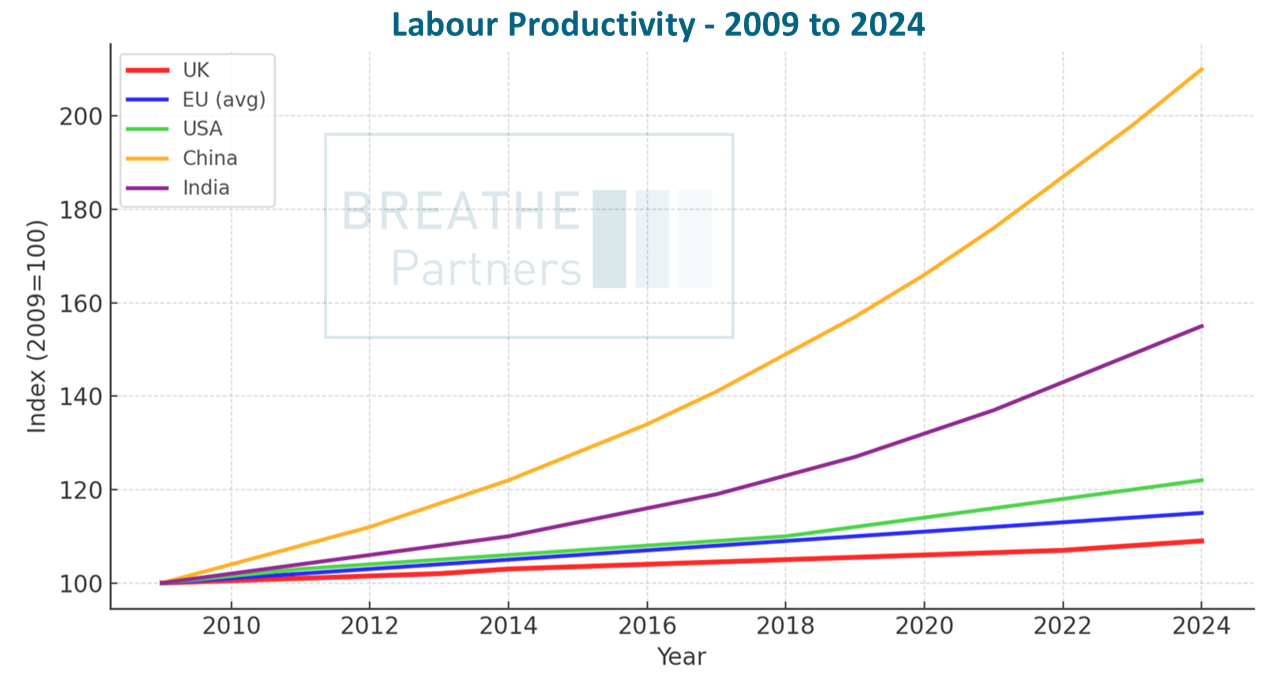

Labour Productivity

Labour productivity in the UK has grown only slowly since 2009, lagging behind the US, China, and India. Productivity is directly linked to energy costs: cheaper, more reliable power supports industrial activity, innovation, and investment. The UK’s relatively high costs have held back gains in output per worker and overall growth.

Real Disposable Income per Capita

Since 2009, growth in real disposable income has been modest in the UK and EU compared with the US, and far below the rapid rise in China and India. High energy costs have squeezed households, limiting spending power. This weak income growth undermines demand and reduces competitiveness across the economy.

Industrial Electricity Prices

UK industrial electricity prices have consistently been higher than those in the US, China, and India, and above the EU average. This leaves UK manufacturers and businesses at a structural disadvantage, with higher input costs. Energy-intensive industries in particular face reduced competitiveness, discouraging investment and limiting productivity growth..

What’s the baseline for the different electricity sources?

This chart compares the future cost of electricity for UK businesses under different generation pathways.

Gas-fired power (CCGT) rises from about £174/MWh in 2025

Renewables are much cheaper: offshore wind, onshore wind, and utility solar hold near £90–100/MWh. Rooftop solar starts slightly higher, at £95–140/MWh, (10p to 14pkWh), less than half the current retail price cap. The Ofgem consumer cap, shown in red, highlights this gap.

Onsite commercial wind can also achieve costs in the £60–90/MWh range at good sites, though planning and land requirements mean solar is usually simpler, while wind is compelling where strong, consistent wind speeds exist,

Data based on the government's own report on electricity generation 2023, and cost based on rooftop solar financials using the same costing methodology

How will these change over time?

Gas keeps rising, heading towards nearly £240/MWh by 2040 as fuel and carbon costs build. Renewables, by contrast, remain flat or fall slightly: offshore wind sits at just over £100/MWh, onshore holds steady below that, and utility solar drops towards £90/MWh. Rooftop solar follows the same downward trend, improving steadily from today’s higher starting point.

What does that mean by the 2030s?

By the mid-2030s, the gap between fossil fuels and renewables is locked in. Gas costs more than twice as much as new wind or solar, while rooftop solar narrows closer to utility-scale prices. For UK businesses, the clear story is that renewables define the low-cost baseline, while reliance on gas locks in exposure to higher, volatile costs.

What about drilling for more Oil and Gas in the North Sea?

The economics of drilling for more oil and gas in the North Sea are often misunderstood. For UK consumers, the price of oil and gas is set on international markets, not by where the fuels come from. Whether energy is imported from the US, Norway, or Qatar, or produced offshore Britain, households and businesses pay the same global benchmark price. Extra drilling does not reduce electricity or heating bills.

As of 2025, oil demand in the UK is around 600 TWh, and North Sea extraction is around 300 TWh, which is approximately 50% of UK oil demand. Gas demand is around 750 TWh, slightly higher than oil, and North Sea extraction is also marginally higher than oil at 350 TWh, which is approximately 47% of UK gas demand. By 2040, based on current policies and licenses, oil demand will be down 42% to 350 TWh, and the North Sea will be producing around 150 TWh (a 50% reduction) of this power, which is about 43% of demand. Gas demand will be down to 47% to 400 TWh, and North Sea extraction will be around 80 TWh, (down 47%) which is approximately 45% of the demand

Where impacts do matter, is in government revenues and energy security. Domestic production is taxed through corporation tax, supplementary charges, and the windfall levy, generating around £6–7 billion in 2024/25, roughly split between oil and gas. Imports, by contrast, bring no tax benefit. Today, the North Sea supplies about half of the UK’s oil and gas demand, but under current policies, this falls to around 43–45% by 2040 despite falling demand (due to net zero policies. Granting new licences could slow the decline, lifting domestic supply to nearly two-thirds of demand and providing the Treasury with an extra £1bn to £1.5bn a year by 2040

From an emissions perspective, burning oil and gas produces the same CO₂ whether sourced domestically or imported, so the climate impact is essentially unchanged. The difference is in upstream emissions: North Sea gas is generally less carbon-intensive than liquefied natural gas imports, which must be cooled, shipped, and re-gasified. That means more local production can modestly reduce lifecycle emissions compared with imports.

The net effect is that new licences could improve energy security, provide modestly higher tax revenues, and slightly reduce upstream emissions. However, they do not lower consumer costs, which will decrease only through reduced fossil fuel dependence and increased adoption of renewable energy.

By slowing the decline of North Sea oil and gas (through extra licenses), this could provide extra forecasted revenue that could be used to fund net-zero initiatives, which in turn could make the UK more competitive. In addition, whilst it might be counterintuitive, there is an argument that granting more licenses for North Sea oil extraction could actually cut global emissions rather than increase them. However, this position is challenging from both a political and communication perspective, as it potentially sends mixed messages about the UK's commitment to net zero.

The Cost of Energy - Use Cases

Vehicles

Right now, if you look at petrol cars, with pump prices at around £1.45 a litre and engines only 25–30% efficient, the energy ends up costing about £475 per MWh. Diesel is slightly better at £1.55 a litre, but with a bit more efficiency, so you’re closer to £450 per MWh.

What about EVs?

The electricity price is the same, but you have to account for drivetrain efficiency. At around 85% efficiency, you’re looking at about £310 per MWh useful energy. That still makes EVs significantly cheaper per kilometre than petrol or diesel vehicles.

What about heating?

Gas boilers are much cheaper. With gas at roughly 6p a kWh and boiler efficiencies around 90%, you’re paying only about £70 per MWh of useful heat. If you switch to electric resistance heating, though, you’re stuck with retail electricity at c.26p per kWh, so that’s about £260 per MWh, far more expensive. Heat pumps are where it gets interesting. At the same 26p electricity price, but with a coefficient of performance of 3, you divide the cost by three. That brings it down to roughly £90 per MWh of useful heat, very close to the cost of gas heating.

Variable Refrigerant (VRF) heat pumps

Buildings with heating, cooling and hot water needs, such as hotels and hospitals, already find air-to-water or variable refrigerant (VRF) heat pumps more cost-efficient than gas or electric systems.

By recovering waste heat between zones and reusing it for hot water, these systems reach COPs of 4.5–5.0, giving a useful heat cost of around £50–£60 per MWh, compared with £70 per MWh for gas boilers and £260 per MWh for electric resistance heating.

Hotels perform especially well because their steady year-round thermal load allows heat pumps to run at stable, efficient conditions rather than cycling on and off.

How do things evolve out to 2040?

Petrol and diesel prices are likely to increase slowly, by about 0.5% per year, so that they will be around 8% higher in 15 years, primarily due to duties and carbon taxes. Gas is likely to creep up faster, around 1% a year, to about 17% higher by 2040, reflecting commodity volatility and carbon pricing. Electricity for resistive heating trends down by about 1% a year, as renewables push wholesale prices lower, so it is likely to be about 14% cheaper by 2040. Heat pumps improve even faster, about 1.5% down per year, partly from more affordable electricity, partly from COP improvements from 3.0 up towards 3.5 to 4.0. By 2040, they’re roughly 20% cheaper than today. EVs will drift down more slowly, about 0.5% a year, as off-peak tariffs and drivetrain efficiency improve. By 2040, they’re about 7% cheaper than today. Overall, fossil fuels, i.e. petrol, diesel, and gas, are broadly flat to rising. Electricity-based options should drift down slowly. By the mid-2030s, heat pumps are expected to be around 20% cheaper than they are today and will undercut gas and electric systems across most commercial buildings. And EVs will stay around 40% cheaper per kilometre than petrol or diesel, even at today’s electricity prices.

The Electric Vehicles Switch Opportunity

204TWh - Electricity reduction

£29bn - Cost reduction per year

The Electric Vehicle Switch Business Opportunity

The UK’s road transport sector is one of the most significant sources of both energy demand and emissions. Today, vehicles consume around 29 billion litres of petrol and diesel per year for company cars, vans, HGVs, buses and coaches, equating to approximately 285 TWh of fossil fuel energy. Transitioning this fleet to electric vehicles (EVs) would instead require approximately 81 TWh of electricity annually (a 72% reduction), reflecting the superior efficiency of electric drivetrains.

The economic benefits are equally transformative. By 2030, a fleet of 10.8 million EVs (Breathe’s forecast based on the government ZEV mandates) could cut operating costs for businesses by around £7.8 billion annually, combining fuel and maintenance savings. Full electrification of vans, HGVs, buses, coaches, and company cars could deliver annual fuel cost reductions of approximately £28 to £30 billion, even after accounting for electricity costs. For businesses, this means lower exposure to volatile oil markets, improved fleet economics, and enhanced resilience against energy shocks.

Unlike fossil fuels, EV charging can be flexible and increasingly localised. With 70% to 80% of HGVs charging at depots and company cars and vans charging predominantly at home or in the workplace, powering these vehicles using onsite solar or wind energy aligns naturally with renewable output. Smart charging and vehicle-to-grid systems can further reduce peak pressures and help stabilise the grid, turning millions of EVs into a distributed storage and balancing asset.

Key Challenges to Implementation

Electrifying the UK’s vehicle fleet faces several barriers. Upfront costs for EVs, while falling, remain higher than ICE equivalents in some segments, particularly HGVs and specialist vehicles. Charging infrastructure deployment is uneven, with rapid and depot charging availability a critical pinch point for logistics and fleets. Grid connection delays also pose challenges: large depots seeking to electrify dozens of vans or HGVs may require local reinforcement works and face long queue times. Additionally, standardisation of charging hardware, payment systems, and smart charging protocols is still incomplete, complicating roll-out at scale

What’s Possible with Government Reforms

With targeted reforms, the EV transition could accelerate significantly and deliver greater cost savings for businesses. Streamlined planning and funding for depot charging, faster grid connections, and clear regulatory support for vehicle-to-grid integration could reduce transition timelines by several years. A robust second-hand EV market would lower barriers for SMEs, while stronger workplace charging incentives would unlock synergies with rooftop solar and behind-the-meter renewables.

Government-backed programmes already point the way forward. The Innovate UK ZEHiD (Zero Emission HGV and Infrastructure Demonstrator) programme is trialling large-scale depot charging and hydrogen refuelling solutions for heavy goods vehicles. These pilots are crucial to proving technical and commercial models at scale, and lessons learned should be mainstreamed quickly into planning rules, grid processes, and fleet transition support.

If these reforms are enacted, electrification could deliver over £30 billion in annual operating cost savings, cut oil imports by nearly 30 billion litres, and reduce UK transport emissions by tens of millions of tonnes CO₂e each year. Beyond cost and carbon, fleet electrification offers businesses a competitive edge: cleaner logistics, lower lifetime costs, and integration with the UK’s evolving clean power system

The Rooftop Solar Opportunity

190TWh - Electricity reduction

£47bn - Cost Reduction per year

The Rooftop Solar Opportunity for Businesses

The UK has over 5.6 million commercial buildings with 2.5 billion m² of roof space, yet only a fraction is used for power generation. Analysis shows that if just 40% of this area were fitted with solar panels, businesses could host around 200 GWp of capacity, producing around 190 TWh of clean electricity annually, equal to approximately 65% of today’s UK electricity demand.

At an installed cost of around £1,100/kWp, this would represent around £220 billion in investment, with a simple payback of 4to 6 years depending on tariffs. Even using business electricity prices (of £0.22 to £0.24/kWh), the generated power would be worth £45 billion per year, cutting collective energy bills by up to £50 billion annually if self-consumed at retail rates. For a typical 10,000 m² warehouse, rooftop PV could save around £190,000 each year, improving competitiveness and resilience.

Unlike remote solar farms, rooftop PV generates electricity exactly where it is used, reducing transmission losses (6–8%), easing grid congestion, and lowering peak demand. Installed alongside workplace EV charging and battery storage, it can directly power electrified fleets and industrial loads, strengthening site-level resilience while slashing emissions. Full commercial deployment could avoid over 100 MtCO₂e by 2035, equivalent to removing more than 20 million petrol cars from the road.

Key Challenges to Implementation

On-site solar faces fewer planning barriers than wind, but there are still persistent hurdles. Grid connection delays (especially over 1MWp) and reinforcement costs can undermine project economics, particularly on constrained distribution networks. Older buildings often have complex roofs that may have limited space for solar panels and may be problematic due to being old, in poor condition, or unable to withstand the required structural weight loading. Planning rules surrounding heritage buildings and visibility can hinder deployment in certain regions. Financing also remains a barrier for smaller firms, with many unable to fund the upfront capex despite strong payback periods (Breathe can help find funding). Finally, split incentives in rented commercial properties, where landlords own the roof but tenants pay the bills, continue to hinder uptake in a significant portion of the building stock, which can sometimes be overcome through a system cost-benefit approach.

What’s Possible with Government Reforms

With targeted reforms, the commercial rooftop solar opportunity could expand rapidly and be delivered much more quickly, resulting in tens of billions of pounds in annual energy bill savings. Streamlined planning and a presumption in favour of rooftop solar would unlock deployment across more of the 5.6 million commercial buildings. Prioritised behind-the-meter grid access, reforms to enable private wire sharing across business parks, and flexible curtailment agreements would ease connection bottlenecks. New financial models, such as green leasing, on-roof PPAs, and aggregated procurement, would lower upfront hurdles and align incentives between landlords and tenants.

Together, these reforms could accelerate rooftop solar roll-out from around 19 GW today to over 200 GW by 2035, delivering approximately 190 TWh of annual generation.

Onsite Wind Opportunity for UK Businesses

45–60 TWh - Electricity Reduction

£2bn to £4bn Cost Reduction per year

The UK has one of Europe’s strongest wind resources, yet very little is harnessed directly by industry. Analysis suggests that between 3,000 and 7,000 large commercial and industrial sites have both the space and wind conditions to host a single modern turbine in the 1.5–2.0 MW range. If realised, this would deliver 15–35 TWh of clean electricity annually — equal to 5–12% of the UK’s current electricity demand.

At a levelised cost of £40–80/MWh, on-site wind is almost half the cost of rooftop solar and far below prevailing grid electricity prices. A single turbine can produce 4 to 5 GWh per year, enough to cover the baseload of a typical factory, stabilising energy bills and improving competitiveness. Across thousands of businesses, this could cut collective energy costs by £1 to 2 billion annually, while reducing exposure to volatile fossil markets.

Unlike remote wind farms, on-site turbines generate power at the point of use, reducing transmission losses, easing grid congestion, and supporting local resilience. Paired with rooftop solar and batteries, they provide a round-the-clock renewable supply that better matches industrial demand patterns. For businesses with land and planning headroom, on-site wind represents a transformative prize: long-term price certainty, significant carbon reductions, and a new competitive edge in a low-carbon economy

Key Challenges to Implementation

On-site wind for businesses faces several persistent barriers. Planning remains the most significant hurdle: turbines are subject to strict rules on tip height, visual impact, noise, and shadow flicker, which makes approvals slow and uncertain compared with rooftop solar. Grid connection is another challenge, as 1–2 MW turbines often trigger costly reinforcement works and lengthy queue times, particularly on constrained distribution networks. Project complexity also deters uptake: installing a turbine requires significant civil works, specialist cranes, and long lead times, making it feel more like an infrastructure development than a building upgrade. Finally, financing remains limited, with banks and leasing providers far more comfortable with the well-established solar market than with single-turbine industrial projects

What’s Possible with Government Reforms

With the right reforms, the commercial on-site wind opportunity could at least double in scale and be delivered up to 70% faster, saving businesses £2–4 billion annually on energy costs. Today, around 3,000–7,000 sites are realistically viable, equating to 15–35 TWh of annual generation and £1–2 billion in cost savings. Streamlined planning and improved grid access could expand this to 10,000–12,000 sites, delivering 45–60 TWh each year — up to 20% of UK electricity demand — and cutting business energy bills by £2–4 billion annually. At the same time, planning and grid delays that currently stretch projects over 3–7 years could be reduced to 1–3 years, making on-site wind projects comparable in speed to rooftop solar.

Unlocking this requires a handful of targeted changes. First, streamlined planning approvals for turbines on industrial land, with clear national standards for noise, setbacks, and height, would remove the uncertainty that currently blocks many applications. Second, improved grid access — prioritising behind-the-meter renewables, enabling private wire sharing across industrial estates, and allowing flexible curtailment agreements — would clear one of the largest barriers to uptake. Finally, finance innovation through corporate PPAs and leasing models could lower upfront capital hurdles, while explicit policy recognition of on-site wind as part of the UK’s energy security and net-zero strategy would provide long-term investor confidence. Together, these reforms would elevate wind to the same level of accessibility as solar, enabling businesses to capture billions in savings while delivering a significant share of the UK’s clean power needs.