The Business Economics

for Green Energy

Executive Summary

UK businesses face some of the highest and most volatile energy costs in the developed world. North Sea oil and gas production is in steep decline, leaving the UK exposed to global markets. At the same time, the UK has world-class offshore wind resources and the opportunity for scale solar power, which are structurally cheaper than imported gas, and a chance to reset the foundations of competitiveness.

Government data shows that by 2025, gas-fired electricity costs around £174/MWh delivered, rising to £240/MWh by 2040. In contrast, offshore wind, onshore wind, and utility-scale solar are holding steady at £90–100/MWh, while commercial onsite solar costs £95–140/MWh today with scope to fall further. By the 2030s, all fossil fuels will be at least twice as expensive as renewables. On the demand side, EVs are already 40% cheaper to run per kilometre than petrol or diesel, and heat pumps are expected to undercut gas boilers by the mid-2030s

The direct opportunity for business is enormous. Commercial rooftops alone could generate up to 190 TWh of electricity per year, anchoring long-term energy costs and saving up to £45bn annually. Switching fleets to EVs would cut transport energy demand from 285 TWh today to just 81 TWh, a 72% reduction, lowering costs from £46.5bn to £17.8bn, or as little as £8.1bn if powered by on-site solar.

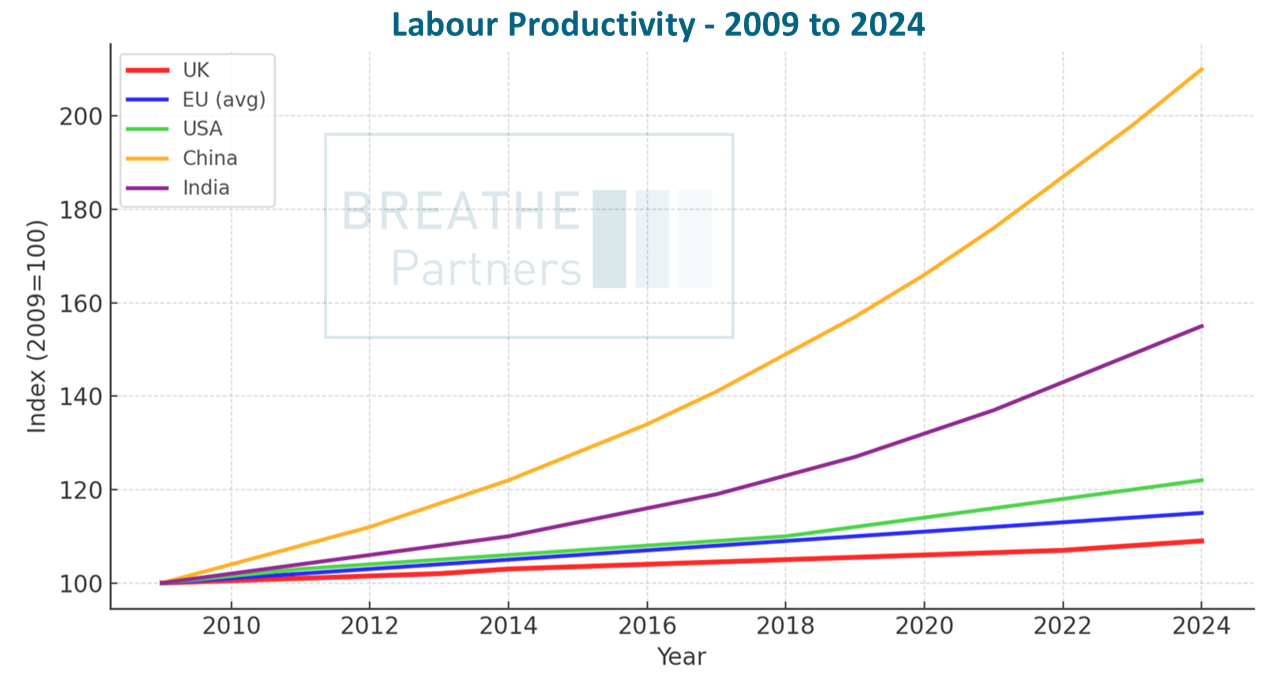

This transition is not just an energy shift but an economic imperative. The US has grown faster in part because cheap domestic energy has underpinned competitiveness, while higher electricity prices in the UK and EU have weighed on productivity. By cutting costs through renewables, UK businesses can boost efficiency, free up capital for investment, and re-energise GDP growth. Meanwhile, the US, China, and India continue to benefit from cheap domestic fossil fuels, while the UK and EU remain exposed to high-cost imports.

For UK businesses, the path is clear. Early investment in renewables, on-site solar, heat pumps, and EV fleets is not just about net zero; this transition is a critical business lever to lower costs, increase resilience against volatile markets, and achieve long-term global competitiveness.

Background

To restore the UK's competitiveness and growth, green energy is a critical part.

The UK has experienced low GDP growth for more than 20 years

This was accompanied by stagnant productivity and a limited increase in disposable income

Lack of UK growth correlates with the High UK’s electricity price, suggesting this is part of the problem.

As you can see, the UK has the highest electricity prices!

What’s the baseline for the different electricity sources?

Based on the government's own report on electricity generation 2023, and cost based on rooftop solar financials using the same costing methodology, it's easy to see how green energy can help re-energise uk business growth whilst also reducing emissions.

In 2025, gas-fired generation (CCGT) is the most expensive once you include delivery, coming in at around £174/MWh. Renewables are already far cheaper: offshore wind is about £104/MWh, onshore wind about £98/MWh, and large-scale solar about £101/MWh. Rooftop solar is slightly higher, at around 95–140/MWh.

How will these change over time?

Gas keeps rising, heading towards nearly £240/MWh by 2040 as fuel and carbon costs build. Renewables, by contrast, remain flat or fall slightly: offshore wind sits at just over £100/MWh, onshore holds steady below that, and utility solar drops towards £90/MWh. Rooftop solar follows the same downward trend, improving steadily from today’s higher starting point.

What does that mean by the 2030s?

By the mid-2030s, the gap between fossil fuels and renewables is locked in. Gas costs more than twice as much as new wind or solar, while rooftop solar narrows closer to utility-scale prices. For UK businesses, the clear story is that renewables define the low-cost baseline, while reliance on gas locks in exposure to higher, volatile costs.

What about drilling for more Oil and Gas in the North Sea

Increasing oil and gas extraction from the North Sea would do little to reduce UK electricity costs, because production is already in long-term decline and any new volumes are small compared to demand. More importantly, North Sea gas is sold at international market prices, so UK consumers and businesses still pay global rates rather than benefiting from a cheaper domestic supply. Since gas remains the marginal price-setter in the UK power system, electricity prices will continue to follow global gas markets unless the generation mix changes. By contrast, renewables are already far cheaper, with offshore wind, onshore wind, and solar typically costing £90–140/MWh, compared to around £174–240/MWh for new gas-fired power. This means that building more gas capacity, even if domestically sourced, would lock the UK into a higher-cost trajectory, whereas doubling down on renewables offers a direct route to lower and more stable business electricity prices.

The Cost of Energy - Use Cases

Right now, if you look at petrol cars, with pump prices at around £1.45 a litre and engines only 25–30% efficient, the energy ends up costing about £475 per MWh. Diesel is slightly better at £1.55 a litre, but with a bit more efficiency, so you’re closer to £450 per MWh.

What about EVs?

The electricity price is the same, but you have to account for drivetrain efficiency. At around 85% efficiency, you’re looking at about £310 per MWh useful energy. That still makes EVs significantly cheaper per kilometre than petrol or diesel vehicles.

What about heating?

Gas boilers are much cheaper. With gas at roughly 6p a kWh and boiler efficiencies around 90%, you’re paying only about £70 per MWh of useful heat. If you switch to electric resistance heating, though, you’re stuck with retail electricity at c.26p per kWh, so that’s about £260 per MWh, far more expensive. Heat pumps are where it gets interesting. At the same 26p electricity price, but with a coefficient of performance of 3, you divide the cost by three. That brings it down to roughly £90 per MWh of useful heat, very close to the cost of gas heating.

How do things evolve out to 2040?

Petrol and diesel prices are likely to increase slowly, by about 0.5% per year, so that they will be around 8% higher in 15 years, primarily due to duties and carbon taxes. Gas is likely to creep up faster, around 1% a year, to about 17% higher by 2040, reflecting commodity volatility and carbon pricing. Electricity for resistive heating trends down by about 1% a year, as renewables push wholesale prices lower, so it is likely to be about 14% cheaper by 2040. Heat pumps improve even faster, about 1.5% down per year, partly from more affordable electricity, partly from COP improvements from 3.0 up towards 3.5 to 4.0. By 2040, they’re roughly 20% cheaper than today. EVs will drift down more slowly, about 0.5% a year, as off-peak tariffs and drivetrain efficiency improve. By 2040, they’re about 7% cheaper than today. Overall, fossil fuels, i.e. petrol, diesel, and gas, are broadly flat to rising. Electricity-based options should drift down slowly. By the mid-2030s, heat pumps should undercut gas boilers on useful energy cost. And EVs will stay around 40% cheaper per kilometre than petrol or diesel, even at today’s electricity prices.

The Rooftop Solar Opportunity

190TWh - Electricity reduction

£47bn - Cost Reduction per year

The Rooftop Solar Opportunity for Businesses

The UK has approximately 5.6 million commercial buildings, covering an estimated 2.5 billion square meters of roof space (the space inside the M25). If 40% of that area were fitted with solar PV, the impact would be transformative: It would deliver 190 TWh/year, equivalent to 65% of the UK’s entire 2024 electricity demand and four times more than the UK solar capacity target for 2030. This would save £47bn annual costs for businesses with an expected payback of 4 to 6 years! Unlike remote solar farms, rooftop solar supplies power close to where it’s consumed, cutting transmission losses by 6 to 8%, easing peak demand, and deferring grid reinforcement costs. In addition, coupled with storage or flexible loads, rooftop systems can support local load balancing and resilience.

The Switch to Electric Vehicles Business Opportunity

204TWh - Electricity reduction

£29bn - Cost reduction per year

Businesses have the opportunity to reduce their energy requirements for vehicles by 72% by transitioning from ICE vehicles to electric vehicles. This would cut the cost of fuel for these vehicles from £48.5bn to £17.8bn, a cost reduction of £28.7bn (62%) based on grid electricity

In addition, if businesses charged their vehicles from onsite solar, then the cost-benefit case would assume an electricity cost of c.£10p/kWh (£100/MWh) and the associated fuel benefit would be £38.4bn. However, it's important not to double-count the financial benefit of commercial solar in this circumstance. it's also important to note these savings do not include maintenance costs, which are also much less for electric vehicles compared to their ICE counterparts or improved vehicle efficiencies